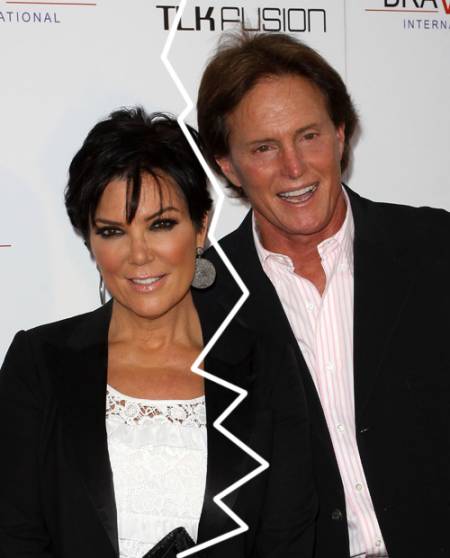

Kris and Bruce Jenner are making headlines once again. What a surprise. The two, after being separated almost a year, are getting divorced. “Momager” Kris officially filed earlier this week. TMZ reported that the decision was “totally amicable” and that no lawyers will be involved in the divorce process. Obviously, there is a lot to separate when it comes to assets...both of them had and have quite a lot.

Though they've told press that separating their estates has been "easy and amicable" and without lawyers, what are the legal concerns that arise with separating everything with only business managers present and without lawyers? What are the legal concerns with a couple that is so wealthy? Even if the separation goes swimmingly now, what are the future legal concerns with the assets that they have agreed to split since there are currently no lawyers involved?

We touched base with Kaine Fisher, local attorney and Chairman of the Family Law Department at Rose Law Group, and asked him to weigh in on high profile celebrity divorce.

“Sometimes I think to myself, why in the world did I go to college for four long years, major in Political Science (a relatively useless degree unless headed to law school), study vigorously for and take a mind-numbing LSAT, spend over $180,000.00 to attend law school so I could sit through boring classes which did nothing to prepare me for the real world, study for 24 hours-a-day for what seemed like eternity so I could sit for a grueling 2-day bar exam in an airport hangar with what seemed like a billion other maniacally stressed out test takers, and then ultimately decide to spend many years practicing family law which causes me to lose countless hours of sleep over the fear of malpractice lawsuits, bar complaints, and certifiably crazy clients. Well, believe it or not, there is a reason we have lawyers. We are trained to see things that others simply cannot.

I have no doubt the Jenners’ business managers have a keen understanding of the parties’ financial picture. What they don’t have is experience litigating divorce matters. Time after time I come across litigants who insist on doing their own divorce with the assistance of trusted non-lawyer advisors. This is not advised even if everyone is singing kum ba yah at the moment. Here’s why. I have truly seen just about everything – and more than once. As divorce lawyers, we are expected to know everything about everything. Think about it. We are called upon to assist our clients with their custody issues, help them divide up their multi-million business interests, understand their complicated financial investments, educate them about the current state of the real estate market, guide them when it comes to tax or bankruptcy implications, help them plan for their financial future after divorce - hell counsel them off a ledge if need be. I trust the same cannot be said for a ‘business manager.’ Don’t get me wrong I’m not knocking their role in the world. But there is something to be said about a professional who is competent to handle all aspects of a divorce.

Let me give you an example. Most people imagine a Parenting Plan that deals with a regular access schedule, and maybe some holidays, and that’s about it. But there is much more. In fact, some of my Parenting Plans consist of more than 20 pages. It includes provisions dealing with very important matters that most people would not even think of unless they have been faced with them. This where my experience comes in. I can assure you I have been faced with them and I certainly will not forget to include them in your Parenting Plan. Same goes for dividing up a business or other assets. Sure, a business manager may have some knowledge about taxes in general-but- the question is, will that business manager know the tax implications of paying or receiving spousal maintenance and child support upon finalization of a divorce? Will they know whether or not there are tax implications associated with the transfer of property pursuant to a divorce decree? Has the business manager assisted people in valuing and dividing good will of a business? Are there different types of good will, and if so, are each divided the same? Let me give you an even broader example. There are still 9 states in the U.S., which are classified as ‘community property’ states (Arizona included). I sincerely doubt a business manager is going to understand the oftentimes-intricate differentiation between a ‘common law’ jurisdiction and a ‘community property’ jurisdiction.

You must trust me when I say you will not be happy when you run into an issue, post-divorce, that was not carefully contemplated by your divorce decree, or even left out altogether. As if going through the underling divorce was not stressful enough. Undoubtedly, you will then have to hire a lawyer (which you should have done in the first place) and spend many more months fixing the mistake. So, hire a lawyer from the start – especially when you have children or any assets to speak of.”

This post is brought to you by

For advice from Rose Law Group, call 480.505.3936 or visit their site here.